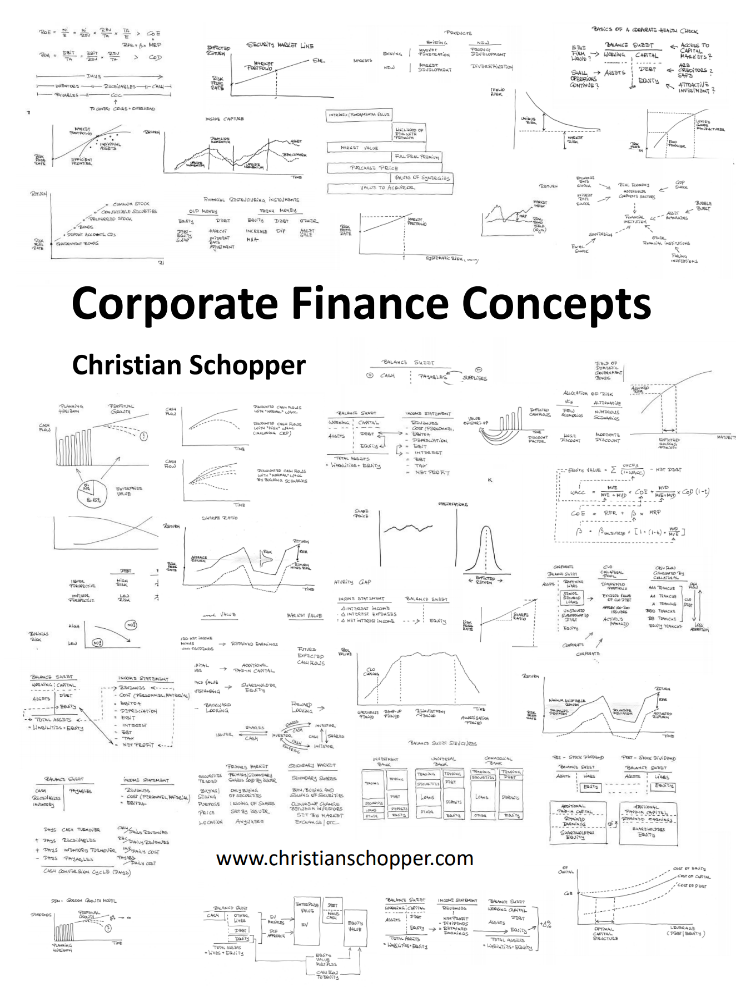

corporate finance concepts, corporate finance, finance concepts, christian schopper, schopper christian, christianschopper, nes, new economic school, financial university, presidential academy, morgan stanley, merrill lynch, bank of america, corpfince, corporate finance central europe, corporate finance, corporate finance concepts, restructuring, m&a, mergers, acquisitions, banking, investment banking, capital markets, crisis, bank crisis, bonds, fixed income, credit, credit rating, securities, shares, stocks, cost of capital, dividends, share buyback, share buybacks, share repurchase, cancellation of shares, dividend policy, stock dividends, dividends, strategic corporate finance, finance and strategy, corporate life cycle, life cycle, company life cycle, life cycle of companies, m&a mechanics, valuation, valuation of companies, valuation of corporates, company valuation, corporate valuation, valuation of Startups, Startup valuation, early stage valuation, bank management in crisis, bank management, management of banks, financial analysis of banks, bank analysis, primer on bank analysis, financial crisis, 2008, investment banking, corporate banking, merchant banking, risk in finance, financial risk, risk and return, financial return, financial risk, volatility, risk in finance, financial volatility, market portfolio, risk free rate, yield curve, financial yield, financial return, sharpe ratio, modern portfolio theory, mpt, cal, cml, sml, efficient frontier, capital asset line, capital market line, security market line, capm, capital asset pricing model, corporate financial analysis, corporate analysis, company analysis, corporate financial health check, health check of companies, company financial health check, corporate health, company health, 5 minute corporate analysis, retrun on equity, roe, shareholder perspective, roa, return on assets, management perspective, working capital, ccc, cash conversion cycle, liquidity,credit rating, credit rating agency, organic growth, corporate organic growth, company organic growth, cost of equity, coe, risk free rate, rfr, beta, corporate beta, levered beta, unlevered beta, levered and unlevered beta, market risk premium, mrp, capital market premium, cost of capital, coc, optimizing cost of capital, cost of capital optimization, valuation, company valuation, corporate valuation, valuation of companies, valuation of corporates, price and value, company value, corporate value, book value, bv, market value, mv, book and market value, market and book value, equity value, ev, enterprise value, equity and enterprise value, enterprise and equity value, share value, valution of shares, stok value, valtion of stocks, dcf, dicsounted cash flow, discounted cash flow valuation, cash flows, cf, cash flow, wacc, weighted average cost of capital, dcf methodology, discounted cash flow methodology, country risk premium, country risk, russia, dividend discount model, ddm, adjusted present value, apv, prepaid, prepaids, pre-paid, pre-paids, acquisition premiums paid, acquisition premia paid, comps, comparable company valuation, comparable company valuation approach, comparable companies valuation, residual cash flow, residual cash flow approach, rcf, venture capital, venture capital perspective, rationale of stock dividends, stock dividends rationale, stock dividend, stock dividends, dividends, funding principles, principles of funding, early stage funding, funding of early stage, growth stage, growth stage funding, funding of growth stage, maturity, maturity stage, maturity stage funding, funding of maturity stage, decline, declining stage, declining stage funding, funding of declining stage, restructuring, corporate restructuring, company restructuring, asset separation, divestitures, spin-off, spinoff, split-off, splitoff, splitup, splitup, distress, financial restructuring in distress, restructuring tools, restructuring tools in distress, bank analysis, analysis of banks, loan policy, loan process, loan terms, camels, capital adequacy, asset quality, management quality, earnings quality, liquidity, sensitivity, leveraged loans, high yield bonds, hy bonds, leveraged loan, high yield bond, country risk premium for russia, cdo, clo, abs, mbs, cmbs, rmbs, covenance, cov-lit